Money Management Tips For Small Business Owners

When tax season comes around, you want to be ready, not scrambling to get things in order at the last minute. Many entrepreneurs can agree that the accounting side of the business is one of the hardest parts of running a business.

To be smart about finances, you must fully understand all things finance to manage money effectively. Let’s get you on the right track to handle your small business finances like a pro.

ATTENTION: You should always consult your accountant/lawyer before implementing any advice from online sources.

Start a business without going into debt

With Print On Demand, you can start earning money practically for ‘free’. However, first-time entrepreneurs spend their money in the wrong places. If you can, minimize the odds of going into debt right off the bat.

Print On Demand is a lucrative field for anyone who is looking to maximize their profits with the least upfront cost.

If you are like me, you want everything to be picture-perfect. But the truth is you need to get started within your means. You may want to hold off on buying a fancy (expensive) website template, unnecessary plugins, and other things that may be weighing your business down. All you need to do is get started with the basics and upgrade as a business grows.

Pro Tip: Interested in moving the needle forward? Think about reinvesting back into your business. You may want to look into certain classes, courses, or books to further your education as an entrepreneur. Check out some of the 2020 Ecommerce Conferences That You Don’t Want to Miss.

2020 Ecommerce Conferences That You Don’t Want to Miss

Pro Tip #2: First, spend money on acquiring new customers. Once you have a solid base of customers, you may want to spend money on retaining existing customers instead.

Create a realistic budget

Every successful business consists of a solid business plan and budget. Setting your budget the first time around doesn’t have to be accurate. As your business grows, the more precise your budget projections will be.

With that said, do not set unrealistic expectations. Don’t get me wrong, ambitions are grand, but you shouldn’t set your budget based on your aspirations. Be realistic. It’s better to be conservative because any extra income is a plus.

Separate business and personal expenses

It’s common for first-time entrepreneurs to keep all expenses (personal and business) under one account.

When it comes to running a small business effectively, you may want to open a separate bank account to keep all your finances organized.

When you separate the two you are less likely to run into tax issues, personal liability issues, and mixed up accounting records.

The more organized you are, the better you’ll be come tax time – more tax deductions.

What to look for when choosing a bank for your business?

A bank for your small business may be different than a bank for your personal use. It may seem like a no brainer to open a business account with a bank where you’ve already established a relationship, but it may not always be the right move. Put on an investigator hat and start looking for a bank that fits your needs. Make sure to look at:

- Any fees

- ATM accessibility and location

- Credit card processing

- Wire transfers

- ATM fees

- Types of accounts

Get free finance app(s)

There are many different apps that you can put to use. Here are some of my favorites.

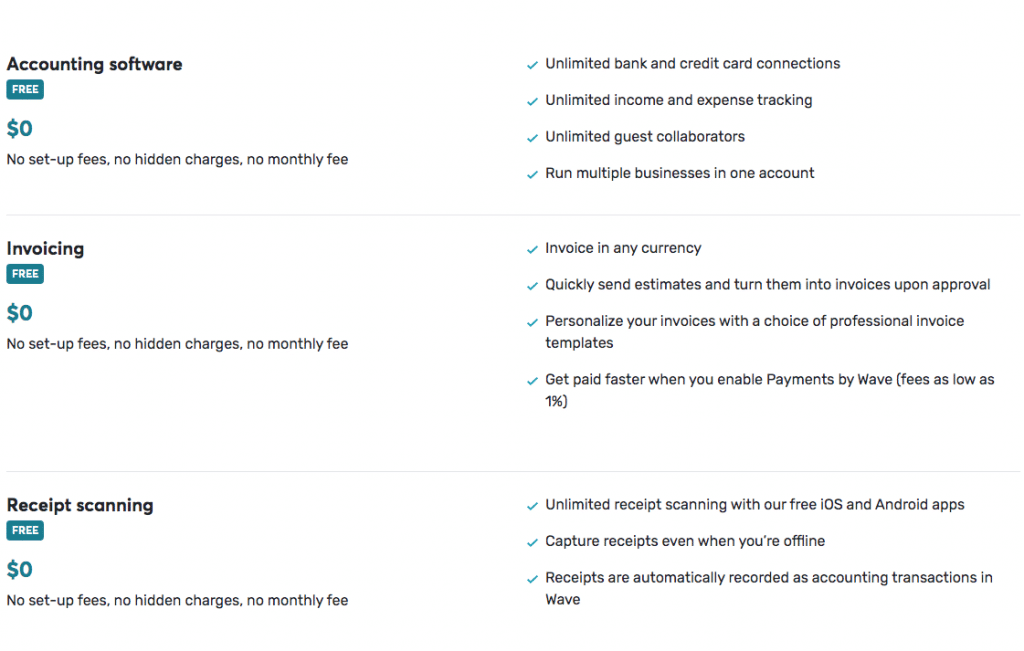

Waves – Manage your accounting, payroll, and invoicing for free. It’s both available on desktop and on the go. If you are interested, read all the details here.

Mint – Connect your bank and credit card accounts to receive weekly and monthly reports on your spending. I love this app because you can set budget and goals, and Mint will inform you if you are overspending or hitting your goals. Then you can adjust your spending habits appropriately.

What to expect as a Small Business owner during tax season?

When a business doesn’t have a physical presence in a state, collecting tax on purchases is not required.

For ecommerce site owners, the one thing you will have to research is how your state classifies a physical presence. In legal terms, this is called a nexus, and each state defines nexus differently.

Tax laws can be complicated. It is in your best interest to reach out to your state’s revenue agency or a professional to make sure you are basing your taxes off correct information. They should be able to explain any specific situations and tax exemptions that you may encounter as a seller.

Tax laws are constantly changing. If you are serious about your business, you may want to consider investing in a tax professional.

Pro Tip: If you want tax deductions to play to your advantage, you may want to consider purchasing tax-deductible items (supplies.etc) before the end of the year so you can claim them on your tax return in April.

As a business owner, you will want to implement some of these practices to keep everything neat and organized. The general tax rule: keep all of your records on file for at least three years.

- Keep receipts, bank statements, invoices, payroll records, and any other documentary evidence that supports an item of income, deduction, or credit shown on your tax return.

- Store all the files both in a cabinet and electronically to access the files when you need to quickly.

- You may want to set up a separate email for accounting purposes or use labels in Gmail to separate finances from other emails.

![]()

- Backup your files in two different places. Losing/misplacing important documents can mean missing out on a big chunk of deductions.

How do you pay yourself?

You have two options when it comes to paying your hard work.

Salary – If you decide to pay yourself a salary, tax withholdings come out of your gross pay automatically.

Draw – A draw refers to an owner taking funds out of the business for personal use. A draw is taxable as income on the owner’s personal tax return.

How to plan for retirement?

Many first-time entrepreneurs get caught up with making money now and often forget about the future. I am not talking a 5-year or a 10-year plan, but something much further down the road – retirement. Every business owner should plan on the future even if they thought that their business would sustain forever. You may want to take a look at some options and start contributing to your 401K, Traditional IRA, or Roth IRA.

The Importance of Tracking Your Numbers

Tracking your expenses and incoming monies can be a daunting task, but when you get a grasp of your finances you will become more confident, less anxious, and finally have an overview of what’s working and what’s not. Knowing the deeds provides a roadmap for the growth of your business.

As a business owner, there are a few major numbers that you should track – pay attention to total sales, expenses, and overall profit. For this, you can use Waves to follow all the things that are important to your business. Additionally, Google Analytics will help you understand where and how your sales are coming so you can budget properly.

Be sure to know the minimum number you need to meet to breakeven (to cover expenses and taxes). On top of that, you need to figure out how much your time is worth.

Can you pay yourself $30/hr to meet industry standards? If you can’t pay yourself the amount you want, you must eliminate cost somewhere else to make profits.

Keeping records also helps you prepare for seasonality of your business (holidays, events…etc.) so you can prepare for those off months with more confidence.

There you have it. Understanding your numbers will no doubt help your business thrive in so many ways. Is there anything that I missed?

In the comments below, I would love to hear the things you’ve learned the hard way in managing small business finances. I’d love to hear your thoughts.

Thank you as always for taking the time to read this week’s post. See you next time, friend!