Nexus Laws and Requirements By States

As an online seller, you need to know where you have sales tax nexus in order to be compliant with the rules in that particular state or states.

We recommend visiting Avalara.com to get a better understanding of all the requirements.

History

Back in the day, it used to be that states could only tax sales by businesses with a physical presence in the state. The rise of the internet and online sales has driven many states to update the definition beyond brick and mortar stores.

To capture these lost sales, many states have enacted economic presence nexus statutes.

What does it mean for out-of-state sellers?

As an ecommerce seller, if you sell products to certain states you are required to remit sales tax to those particular state regardless if you are physically present in that state.

When your ecommerce business exceeds the minimum economic threshold standards, you should have accounting systems in place to assess, collect, and remit sales tax on applicable sales.

Hire a tax consultant that specializes in this and have them review each state’s law to determine a strategy for each state.

This should be done annually because changes are made all the time.

What are the thresholds that create economic sales tax nexus?

The thresholds vary by state. Many states adopted thresholds that are based on sales revenue, transaction volume, or a combination of both.

Nexus Types

- Economic Nexus

- Affiliate Nexus

- Click-Through Nexus

- Cookie Nexus

- Tax on Marketplace Sales

- Non-Collecting Seller Use Tax Reporting

Economic Nexus

The connection to a state can include a variety of things. Check out the image below.

Affiliate Nexus

States such as New York, Pennsylvania, Texas, and California have laws in place that require certain out-of-state businesses to remit sales tax when they have an affiliate or subsidiary relationship with an in-state counterpart.

These relationships are defined differently in each state, even though they’re typically categorized as “affiliate nexus.”

Click-Through Nexus

For example, there’s a particular website, that links to your business from their site via an affiliate program. When someone clicks and purchases your products through the website, you pay the website owner commission from the sale of the product.

Usually, you can find something along those lines on the page that makes commission through affiliate links.

Disclaimer – please note that some of these links below are affiliate links and I will earn a commission on your purchase through those links.

Congratulations you MADE A SALE! That’s awesome, however, now you own sales tax to that state.

Cookie Nexus

Tax on Marketplace Sales

Two parties are involved in a sale – the marketplace seller and marketplace facilitator (eBay, Etsy, and Amazon Marketplace). Let’s take a look at an example below.

Marketplace sellers that don’t have a physical presence in Washington don’t need to make that choice because “the marketplace facilitator will do so on behalf of the seller.”

Keep in mind, each state has different laws and rules. Don’t assume that marketplace facilitator will pay sales tax on your behalf.

Non-Collecting Seller Use Tax Reporting

You must inform customers at the time of sale that you don’t collect sales tax in that particular state, and that the customer may be obliged to pay taxes to that state.

Here’s a sample of Colorado’s transactional notice to consumers.

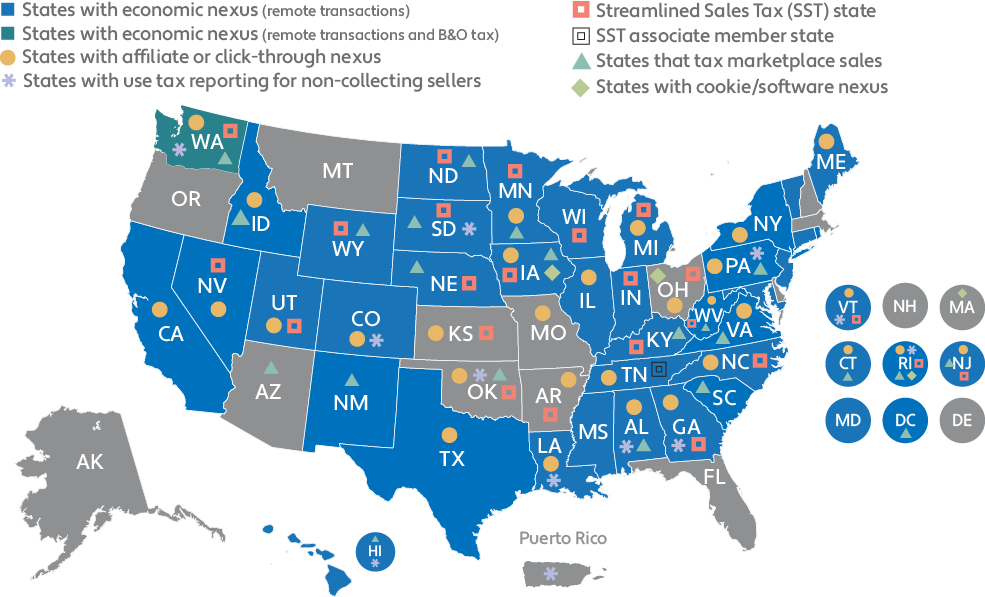

The United States Nexus Map

See the map below for more details by state as of April 10, 2019.

Click here to view a state-by-state guide to sales tax economic nexus rules.

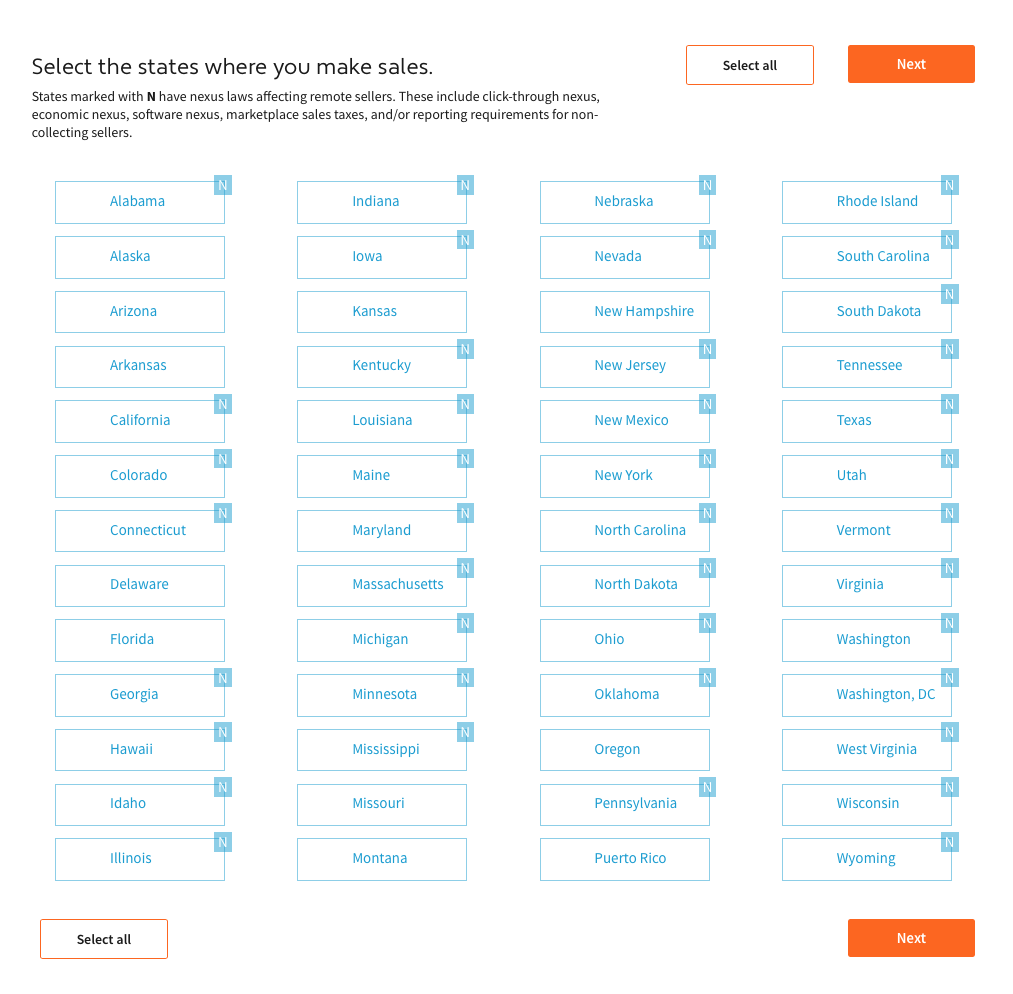

Step 1: Select states where you make sales to get appropriate sales tax information. Click next.

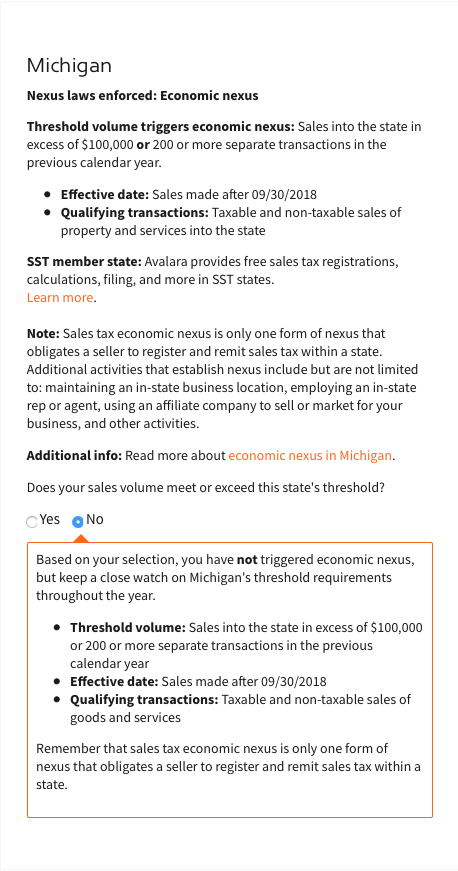

2. Solely for the purpose of this post we selected our home state to show the laws enforced in Michigan.

As an ecommerce seller, things can get complicated. We recommend hiring a professional to stay up to date on the latest rules – heads up they change quite often.